Importance of Insurance

Financial Security: No matter how much you are earning or how much you have saved, your financial position can be dented by an unexpected event in a moment. Therefore, the best way to become financially secure is to cover yourself, your family, and your assets with insurance. You can buy or renew insurance online and receive a payout for financial support, in case there happens to be an unforeseen event.

Complete Protection for You and Your Family: Family is the most important asset that you have, and your family depends on you for financial support. This is why it is important to make sure that you and your family are completely secure to face any emergency.

Peace of Mind: No amount of money can replace your peace of mind. So, when you have insurance, you know that you are secured against any unforeseen events in life

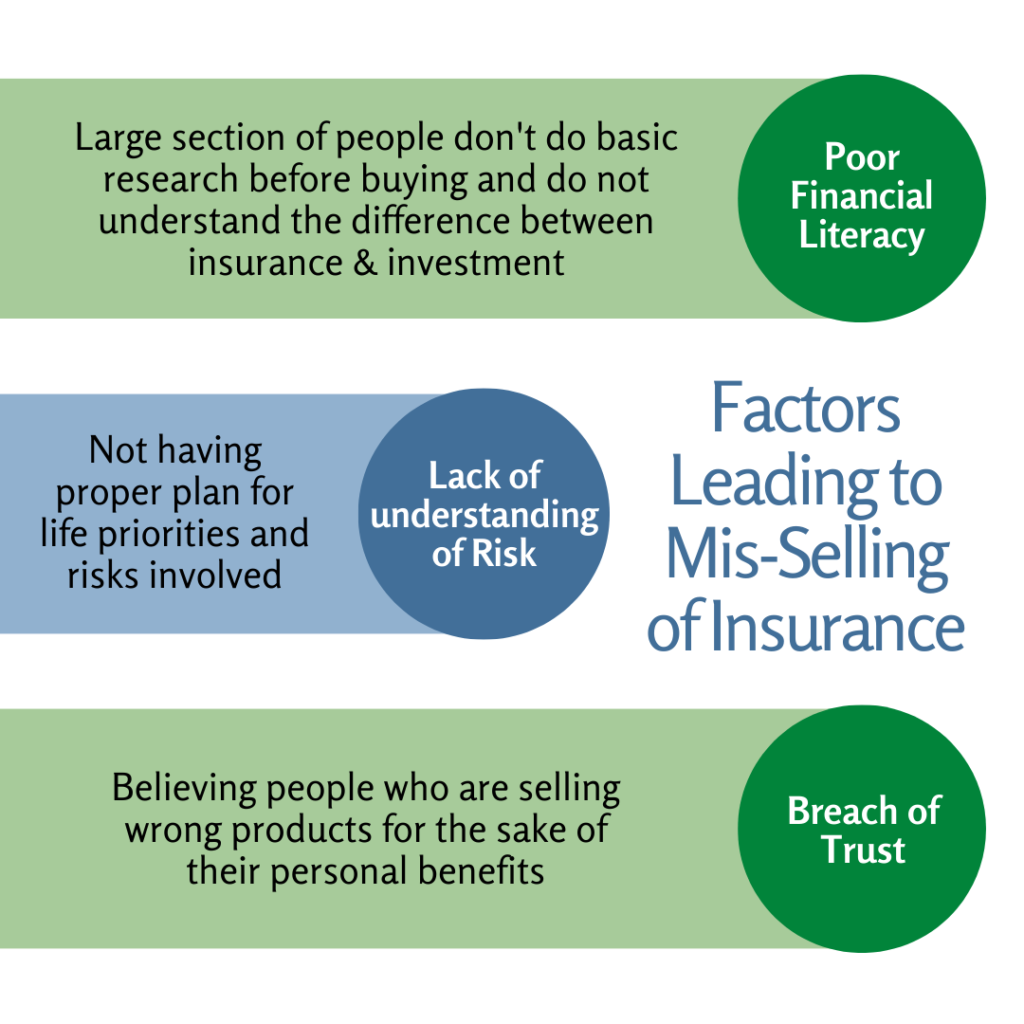

Factors that are leading to mis-selling of Insurance products.

- Poor Financial Literacy

- Lack of Understanding of Risk

- Breach of Trust

What We do at Wealth Tree :

At Wealth Tree, we don’t sell any specific product of Insurance, we provide a solution that is important & required for the client after understanding his risk profile, needs & goals, then suggest the right product which can mitigate the risk.Choosing the Right Insurance

WTG is interested in the economic welfare of every Client. Before picking up the proper insurance policy, we recommend you consider the following factors which determine the credibility of the Insurance Company:- Financial Stability of the Insurance Company.

- Claim Ratio for the last ten years, current claim ratio can be deceptive.

- Premium Charges should be effective, however, the cheapest doesn’t mean it is the best.

- After-sales service and claim support.

- Ensure that your insurance has apt coverage and critical riders.

- Easy-to-buy and easy-to-claim procedures have to be there.

- The claim settlement process should be easy.

Why should you buy your Insurance Policy with WTG?

- Our team determines, evaluates, and provides the best term insurance based on your annual income, age, and other priorities of your life, but not as a fixed method of providing insurance.

- Our insurance team always updates themselves with the best insurance products available in the market to give the best for the clients.

- We also evaluate and analyze the existing insurance policies of our clients & restructure the portfolio based on the client’s needs & Goals.

- Excellent after-sales service with reminders for premium renewals and complete support on maturity or an occasion of claim if it arises.

Wealth Tree Team has extensive experience providing corporate insurance solutions.

What is Business Insurance?

- Business Insurance is the coverage that protects businesses from losses due to events that may occur during the normal course of action.

- They include insurance covering property damage, legal liability and employee-related risks.

Why Employer – Employer-employee insurance?

Benefits to the Employees:- Offers a sense of Financial Security for the Employee

- Increase in belongingness towards the company.

- Will provide income to their families in case of Premature Death

- Benefits of the policy can be used as funds for retirement.

- Acts as an additional Service benefit.

- An attractive tool to retain Talent and develop Employee Loyalty

- Can be part of a Reward program for Selective Employees

- Reduces Attrition

- Delay and Financial Costs incurred in recruiting and training new employees can be avoided by retaining current employees.